NatWest apologises as banking app goes offline

Technology correspondent

Gety pictures

Gety picturesNatWest apologized after leaving customers unable to use their UK mobile banking application, preventing some from reaching their bank accounts.

More than 3000 people have reported problems in the interruption examination that was identified since the first time the problems appeared at 0910 GMT.

The company said on the location of its service condition that the online banking service was still working normally – although this was descended by some customers. Cards payments are not affected.

“We realize that customers are facing difficulties in reaching the NatWest Mobile Banking app this morning,” Natwist spokesman told the BBC.

“We are really sorry for this and are working to fix it as quickly as possible.”

BBC/Natest

BBC/NatestCustomers have moved to the social media of the complaint about the impact of the failure of information technology on them.

One person said they had to “re -shop because of this”, while another said they were “waiting for shopping” but they were unable to transfer money to do so.

NatWest advised customers on social media that it “has no time frame” to reform, but he said that her team is “working hard” to solve it.

Customers are advised to reach their accounts in other ways if they can – such as online banking services.

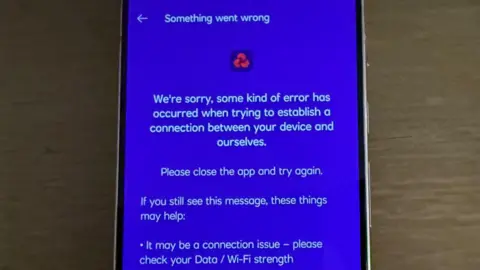

However, some people have reported problems with NatWest online service as well, With the sharing of an error message What they said was offered when they tried to make a boost.

Others expressed his frustration with the bank’s response, as one of them said, “Kan”Disgraceful“There was no time frame, while it was called another.”Very bad service“.

“What I do not get is that the bank closes a lot of branches” to save money “and forcing people to rely on the application and banking services via the Internet … but it is clear that it has not been invested in a system that works properly,” One angry agent said.

Repeated problem

This is the latest in a long series of banking interruption.

In May, a number of major banks It revealed that 1.2 million people were affected by the UK in 2024.

According to a report in MarchNine major banks and building societies spent about 803 hours – equivalent to 33 days – from technology interruption since 2023.

Uncomfortable customers, power outages come at a cost on banks as well.

The General Treasury Committee has found that Barclays may face compensation payments of 12.5 million pounds due to the power outages since 2023.

During the same period, NatWest paid 348,000 pounds, and HSBC paid 232,697 pounds, and Lloyds paid 160,000 pounds.

Other banks paid smaller sums.